Project Revenue

Oracle Projects generates revenue based on the transactions that you charge to your projects. You configure your projects to accrue revenue based on your company policies. You can review revenue amounts online, and can also adjust transactions; these transactions are then processed by Oracle Projects to adjust the revenue amounts for your project. Oracle Projects interfaces the revenue amounts to Oracle General Ledger.

When you generate revenue, Oracle Projects calculates revenue, creates event and expenditure item revenue, determines GL account codings, and maintains funding balances. You can generate revenue for a range of projects or for a single project.

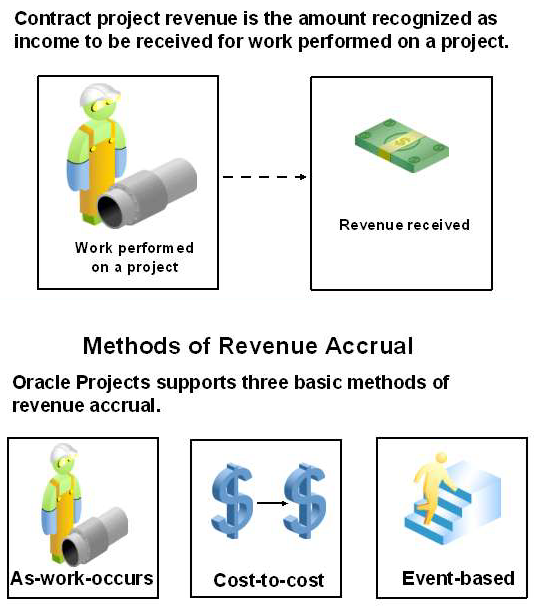

Methods of Revenue Accrual

Cost-to-cost

Based on the ratio of the actual costs to budgeted costs and revenue (referred to as percent

spent)

As-work-occurs

Based on bill rates or markups applied to detail transactions:

• Time and Materials (T&M) when using bill rates, or

• Cost plus when using burden schedules

Event-based

Based on the Oracle Projects client extensions calculations or direct user input from externally

calculated amounts; for example:

• Automated milestone creation

• Percent progress complete calculations

Accounting Dates and Review

How PA and GL dates are determined depends upon the transaction accounting method:

Period-End Date Accounting

- The PA date is set to the end date of the earliest PA period that includes or follows the revenue accrue through date and has a status of Open or Future.

- The GL date is set to the end date of the earliest GL period that includes or follows the PA date of the draft revenue and has a status of Open or Future according to the period status in Oracle General Ledger.

- The PA date is set to the revenue accrue through date if that date falls in a PA period with a status of Open or Future. If the revenue accrue through date falls in a closed PA period, then the PA date is set to the start date of the earliest open or future enterable PA period that follows the revenue accrue through date.

- The GL date is set to the revenue accrue through date if that date falls in a GL period with a status of Open or Future in Oracle Projects. If the revenue accrue through date falls in a closed GL period, then the GL date is set to the start date of the earliest open or future enterable GL period that follows the revenue accrue through date.

Revenue /Invoice amounts1.

Revenue /Invoice amounts

1. Cost to Cost – Its derived from the approved cost budgeted, approved revenue budgeted and the expenditure

Revenue amount = ARV/ACB * Total Cost

2. As work occurs - Based on bill rates or markups applied to detail transactions. Bill rate /Burden schedule.

3. Event – Enter the invoice amount and date.

4.Percent Complete – derived from percent complete and approved revenue budget.

Extensions are not required if standard processes are used.